Today my topic is on the

Handling Scrap or Wastage Items in Production.

You may heard the term

Scrap or Wastage in manufacturing industry. In most basic sense, the scrap is left over material generated from product processing and consumption. Some organization may sale the scrap with tax in market.

SAP Business One didn't provide a default feature for scrap/wastage process, however we can do the same in work around. Here I will show how we can manage

Scrap or Wastage items in SAP Business One.

First create a Scrap/Wastage item in item master. Here I created a Scrap item and its separate warehouse, so that it could manage properly.

We need to do GL determination for Scrap item- assigning general ledger for

Inventory and

Revenue. I am using Advance GL determination to define the rule for this. Before we need to define the GL for Inventory and Revenue. Here you can look at below screenshot

GL detemination for Scrap item-

Create a BOM for Finished Goods there we need to specify the Scrap item with negative quantity.

Regarding quanity for scrap in BOM, it depends on scenario to scenario how much scrap is generated during a particular Finished Goods to be processed.

Here I have made a BOM as you can see in below screenshort. Components of BOM are raw-materials and total consumption is 1 kg and scrap is approx 50 gm in negative quantity. Therefore, the finished goods will be produced 950 gm and scrap will be generated 50gm in 1 kg of raw-material during Goods Receipt from Prodution. I have given issue method is manual because when we do Goods Receipt from Production that time we put actual scrap's quantity. If you want to do backflush as issue method, you can also do that.

Now we see how generate the Scrap item during production with accounting entry. First, I created a production order of Finished Goods.

Create a document for Issue the material for the Finished Goods

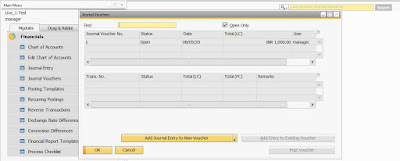

Accounting entry during the issue material for production

Now we do receipt from production for the Finished Goods. Here we can see scrap is also generated while receipt the Finished Goods. You can change the quanity of scrap to actual quanity and also you can enter the cost of scrap for eg. I entered 2.4 INR per Kg.

Accounting entry during the receipt material from production with scrap item

As you see the Scrap Value shows 12 INR on debit side and its WIP account on credit side. Therefore ,scrap cost shows in variance.

When we Closed the Production Order then wip account and variance account are adjusted. Result, Raw-material cost 2275 INR is credited. FG cost 2263 INR and Scrap cost 12 INR are debited . Here you can see the same at below screenshort.

Create a A/R invoice to sale the Scrap item with Tax

Gross Profit of Scrap item as we mentioned the item cost during production.

GL entry of Revenue of Scrap Sale which is posted after saving the A/R invoice.

This is the process to handle Scrap/Wastage in SAP Business One. I hope you like it and please subscribe my Blog- SAP Business One Knowledge by enter your email id so that you will get updates when new blog is posted.